Oil analysis, often called Oil Condition Monitoring (OCM), has been integral to industrial maintenance programs for more than half a century. Throughout its history, it has contributed to maintenance and improving the profitability of the industries that effectively use the reliability service.

Many companies start an oil analysis program and never manage to reach a degree of maturity to see a substantial impact on downtime, an extension of the useful life of the components, improvement of the reliability of the equipment, and adequate planning.

Some clear motivators force industrial plants to implement an oil analysis program for their assets. Referencing a private research study published in 2018, here are common reasons industries turn to oil analysis programs to address challenges and improve reliability:

- Compliance with OEM warranty

- Reduction of lubricant consumption

- Goal to move from preventive to predictive maintenance (although this term leads to many questions)

- Analysis included in the contract for the provision of lubricants

- Decision of maintenance management

- Alignment with other group plants

- Need for improved reliability

Of course, all the above points are intended to take a step towards a stage where information can be obtained from both the fluid and the lubricated component.

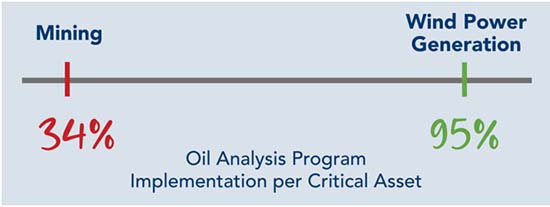

In another private research survey, depending on the industrial sector, implementing an oil analysis program in critical machinery ranges from 34% in the mining sector to over 95% in the wind power generation industry.

Although the oil analysis program implies sending a sample to a laboratory, there is a previous process that, in many cases, is overlooked and leads to a poor contribution from this impactful tool. At the same time, there is a subsequent process that, if it is not followed correctly, will never provide the maturity that any such program requires.

Building a World-Class Oil Analysis Program

Through evaluating survey responses from power generation industry customers on the process they follow when deciding to launch an oil analysis program, answers reveal the virtues and the existing shortcomings throughout the decision-making and subsequent implementation of the program.

The following synopsis briefly describes the process of excellence that leads to obtaining an effective oil analysis program, utilizing the previously mentioned survey as a reference that, above all, contributes to the much-desired availability and maintainability of the machines.

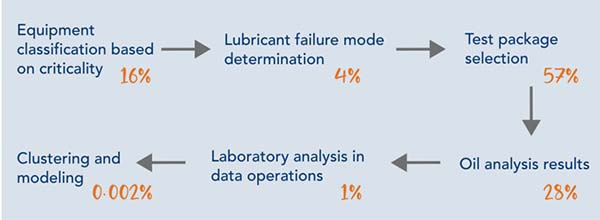

Equipment Classification Based on Criticality

Of the companies surveyed, only 16% started the program considering the criticality of their machines. Depending on the industry, there are a variety of formats to classify and determine the degree of criticality of the assets, but a high percentage have criticality analysis from the reliability point of view.

This is usually one of the first links in the process. Unfortunately, most industries do not consider the asset’s criticality and don’t include it in the oil analysis program; the decision parameter is usually the volume of oil from the asset.

For example, it is common to see that the reducers that are part of the OCM program have a volume greater than 20 liters. However, many of these do not have a high criticality; on the contrary, those with a lower volume are highly critical.

Lubricant Failure Mode Determination

This term is attributed to an event or occurrence that causes the functional failure of the lubricant, or in other words, the reason why the lubricant loses some of its primary functions.

Unfortunately, not all lubricants fail in the same way, and lubricants of the same type (brand and family) can fail in entirely different ways depending on factors related to the operation and service environment.

As incredible as it may seem, less than 4% of the industries have the objective of identifying the failure mode of their lubricants. The remaining 97% follow up on the results and never even consider identifying the problems or the process that has caused the failure of the lubricant.

Selection of the Laboratory Analysis Program & Test Package

The percentage of companies that decide on an oil analysis program based solely on price has skyrocketed exponentially in recent years. In Europe, during the first decade of the 2000s, barely 15% of the industries implemented an oil analysis program based solely on price, while the rest focused on a more technical component.

With time, the balance had been tipping until recently. Today, when price takes precedence over the technical aspects, in many cases, it is left to the laboratory’s suggestion on the analysis that best suits a maximum price.

In other words, the laboratory makes its best technical-economic offer on critical assets. In many cases, this leads to low-quality laboratory tests, which are like darts aimed at a target whose only objective is economic and not the technical benefits that an adequate analysis program should provide.

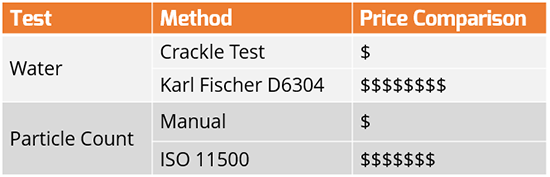

Two clear examples of this situation occur with the determination of water and the counting of particles. Let’s see the relative prices based on each first method:

Companies considering oil analysis that do not consider the technical components (and therefore points 1 and 2 previously described) will logically focus on the lowest prices in the previous table; after all, what difference can there be for a non-technical person without experience between one outcome and the other? Water is water, right?

Thus, 57% of the industries start their oil analysis program based on price without considering the technical side.

Sample Analysis Results & Interpretation

The final product of most commercial laboratories is a report that, in one- or two pages, details each of the tests, analysis performed on a lubricant sample, and maintenance recommendations and observations.

Analysis reports can be complex and challenging to understand. In contrast, in others, its interpretation is relatively simple. Still, both types have in common the inclusion of an overall severity of the result of the condition of the lubricant and/or the component.

The following figure can come as alarming. Barely 28% of the end users of the reports analyze the information contained in them and focus solely and exclusively on the overall severity. There are many reasons for this, but there are three most common reasons:

- Lack of time to dedicate to interpreting results accurately

- Lack of training in understanding the report

- Lack of necessary tools to review and add value to the report

Lubrication and Oil Analysis Program Champion

Very few industries require a lubrication specialist to dedicate 100% of their time to the oil analysis program. Thus, this task falls on various degrees of professionals in the maintenance and reliability team at the company.

The most concerning part here is that sometimes these people have no prior experience in oil analysis and are now forced to understand and learn the benefits of lubrication while balancing their initial roles and responsibilities. Successful, effective fluid analysis programs require the attention of a Program Champion to manage the program.

Integrate Oil Analysis into Maintenance

For 78% of end users, the oil analysis report is the endpoint in a long and complex journey that the oil takes from when it is manufactured to when it is sampled. However, the analysis report is the starting point of the second stage of the product since a series of decisions that directly affect the physical asset are generated from it.

A significant percentage of users consider the task of oil analysis closed until the next round of samples due to flashes on the screens of their maintenance management tool. The impact of oil analysis does not stop here; the report must be compared with the evidence and actions in the maintenance book of each machine and the maintenance data management system.

One of the most impactful values of oil analysis as a tool lies in this. This allows the improvement of availability and the user to demonstrate, contrast and learn what has been detailed in the report.

To say that a handful of industries couple oil analysis information with the rest of the operation and maintenance data is an understatement; barely 1 in every 100 users dedicates time to this task. One of the main barriers for this to work effectively is the lack of buy-in and insufficient tools to do it.

Let’s hope that with the revival of the already famous fourth industrial era, the IIoT, and a steady increase in data integration capabilities, we will see results in this area.

Clustering and Modeling

If, as previously stated, only 1 in 100 users can cross-reference information from both sides of the trench, imagine what happens in this new stage where the goal is aimed at generating models to identify the most common failure modes, not only the lubricant but also of the lubricated component.

1 in 380 users has clarity and can overcome this last obstacle to identify the missing link, becoming an entity that knows its physical assets in-depth and has precise knowledge of the lubricants with which it works. Getting to this point requires knowledge, experience, and an analytical tool.

The benefits of managing an oil analysis program that has been fortunate enough to get to this point are:

- Cost reduction of oil analysis in routine tests

- Early identification of atypical values (outliers) prone to failure

- Analysis of exceptional lubricants (they are usually expensive analyzes, with longer delivery times and identify a specific problem)

- Early identification of asset failures

Those lubrication programs that have reached this degree of maturity are extremely solid and have a technical base. They are programs that focus their program selection based on characteristics as specific knowledge in the industrial sector (not all laboratories who analyze motor oil can effectively do the same with industrial oils) instead of focusing on the cost of the analysis and selecting based on price.

Moreover, these lubrication companies that achieve mature programs focus on identifying the failure mode and determining the inflection point where the asset enters a negative tangent to the well-known P-F curve.

Some Conclusions

If you select your lubrication program based on the lowest price, you should rethink your goal when analyzing the lubricant.

- The oil analysis report is the intermediate point of the lubrication program.

- If your lubrication program is the same from the start, it is likely to become a dead weight that brings neither maintenance nor operation benefit.

- If you don’t know the failure modes of the lubricant and the asset, your lubrication program is simply an unnecessary expense for the maintenance department.

- The data analysis of the reports is one of the most important indicators of the oil analysis program. If you do not analyze this data, your program will remain stagnant and only add value sporadically.