It’s exceedingly rare to find a fleet of vehicles with the same make, model, and year of manufacture. I have never personally observed a single instance in my career. Fleet managers will be all-too-familiar with the challenge of stocking spare parts for their fleet, but an additional issue is that of engine oils.

Choosing the right oil type and keeping a supply is essential, as this can increase inventory costs and complicate inventory management. Moreover, API (American Petroleum Institute), ACEA (European Automobile Manufacturers’ Association), and OEM specifications are constantly changing in response to advances in engine technology and regulations.

So fleet managers must keep up to date to ensure optimal performance, engine longevity, and minimal risk of cross-contaminating with incorrect lubricants.

API C Category – Built for Backward-Compatibility

Backward compatibility is one of the most notable features of API C (Commercial) diesel engine oils. It means that engine oils of the latest generation can be used with older engines built for oil specifications from earlier years without any damage.

Each subsequent API C category specification is designed to be backward compatible. For example, the CK-4 oils can be used with engines designed for the CJ-4, CI-4, and CH-4 categories.

This compatibility is possible because each new API specification maintains the performance characteristics of older oils while adding enhancements that meet the needs of modern engine technology.

This feature is a significant advantage for fleet managers, as they will often have a mixture of different models and asset ages in their fleet. On top of that, engine rebuilds and replacements over the vehicle’s life can mean that engines may require newer generations of oil compared with the manufacturing specification.

API’s backward compatibility means that a single type of oil will meet the needs of older and newer engines, which reduces inventory complexity and the risk of errors.

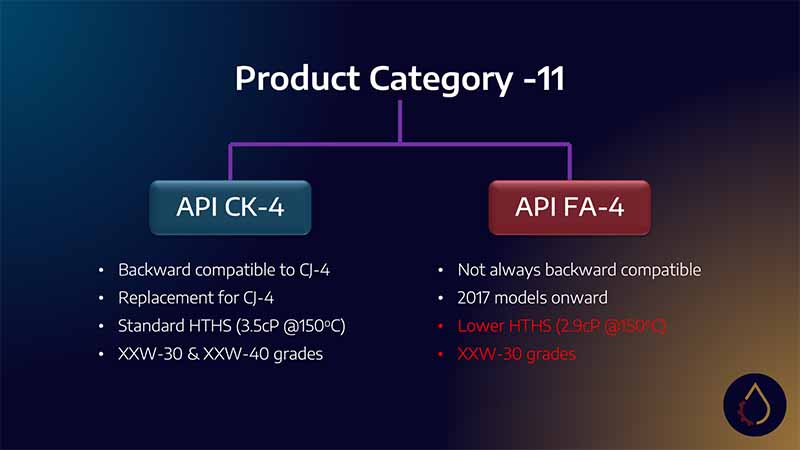

PC-11, the API’s most recent specification, has introduced a new wrinkle. This product category was split in two, with CK-4 being introduced alongside FA-4.

While CK-4 retained the backward compatibility that has become synonymous with API’s commercial engine oil categories, the FA-4 specification is designed with a fuel economy objective.

This category’s lower HTHS and bulk viscosities make it incompatible with the oil specification that preceded it – meaning that fleets likely need to retain a mix of different oil specs unless the entire fleet comprises exclusively 2016 or later engine models.

ACEA – Complicating Things

Regarding ACEA (European Automobile Manufacturers’ Association) E-category diesel engine oils, the situation with backward compatibility differs somewhat from the API approach.

The ACEA specifications are designed to address the specific needs of European engines, often different from those manufactured in the US.

In the ACEA E sequence for heavy-duty engine oils, backward compatibility is not guaranteed. For example, E6 oil may not be suitable for an engine that requires E4 or E7. Each E category is tailored for specific engine technologies and exhaust treatment systems.

For example, using E6 oil in a machine designed for E4 could lead to complications due to differences in crucial properties such as Sulphated Ash, Phosphorus, and Sulphur (SAPS) levels.

Unlike the API Commercial category oils, ACEA has no tradition of maintaining a single category regularly updated along with engine technology requirements. Instead, ACEA maintains multiple active types to cater to various engine technologies and after-treatment devices.

As vehicle technologies and emissions regulations advance, ACEA makes categories obsolete, as in 2022 when E8 and E11 replaced E6 and E9, respectively.

With all this complexity, careful oil selection based on the manufacturer’s recommendation becomes increasingly important when a fleet comprises vehicles from predominantly European OEMs that tend to follow the ACEA specifications.

OEM Specifications – A Challenge to Decode

Navigating the different OEM specifications for diesel engine oil is complicated. Each OEM sets its own specifications for each vehicle based on engine design, materials, and operating conditions.

These requirements are often based on those set forth by the API or ACEA but exceed those requirements in areas dictated by the OEM’s use of particular engine or emissions control technologies.

When selecting oil for a single vehicle, this can be a relatively simple exercise, with many industry tools available for matching vehicles to oil specifications.

The challenge for fleet managers comes when trying to minimize oil inventory while still covering all the necessary approvals to meet requirements and warranties.

At this point, some research may be required to understand where specifications overlap. For example, the Cummins CES 20086 specification is often grouped with ACEA E9, API CK-4, MB 228.31, Volvo VDS-4.5, MACK EOS-4.5, Renault RLD-3, MTU Type 2.1, and/or Caterpillar ECF-3.

The Future – Spoiler Alert: It Doesn’t Get Easier

There is a great deal of ongoing work and discussions in the ever-evolving realm of engine oils. With the recent release of ACEA 2022, the likely next specification release is API’s PC-12.

As with PC-11, it appears the category will be split into PC-12A and PC-12B, with PC-12A being a successor to CK-4 that retains its backward compatibility characteristics and PC-12B being the fuel-economy FA-4 equivalent (nominally FB-4).

Discussions on PC-12 oil drain intervals aren’t pushing for significant extensions beyond what’s currently in practice.

Interestingly, PC-12B is expected to introduce lower high-temperature, high-shear (HTHS) viscosities than we’re accustomed to. This proposal throws a wrench into the mix, adding an extra layer of complexity to the situation.

The lack of compatibility with older specs in Australia and the United States means that using FA-4 oil remains a niche practice. CK-4 oil (and earlier) is still the mainstay for most fleets.

However, if the proposed lower HTHS viscosity for PC-12B is approved, FB-4 may not be backward compatible with the current FA-4 allowance.

This would split the previously distinct API Commercial category into three competing specifications. It’s a fascinating discussion that many Original Equipment Manufacturers (OEMs) are grappling with.

The aim for Commercial Vehicle Lubricants (CVL) is heading in the same direction as passenger vehicles to improve fuel economy and meet the ever-stringent standards.

These changes are all part of the broader goal to increase fuel efficiency and miles per gallon in fleet operations, aligning with ongoing discussions around regulatory standards.

However, it introduces increased complexity for fleet owners, who must navigate an ever-more intricate web of diesel engine oil specifications.