Gears are everywhere. These versatile machine elements are present in all industries and used in pumps and drives of all sizes as a reliable way to transfer power. Industrial gear oils are a vital component of that reliability, helping to maintain separation between the teeth and preventing wear.

But gear oil formulations might be about to change thanks to macro shifts in the base stock market. These alterations always have downstream impacts – and in the coming years, we may see the prevalence of varnish increase in gearboxes worldwide.

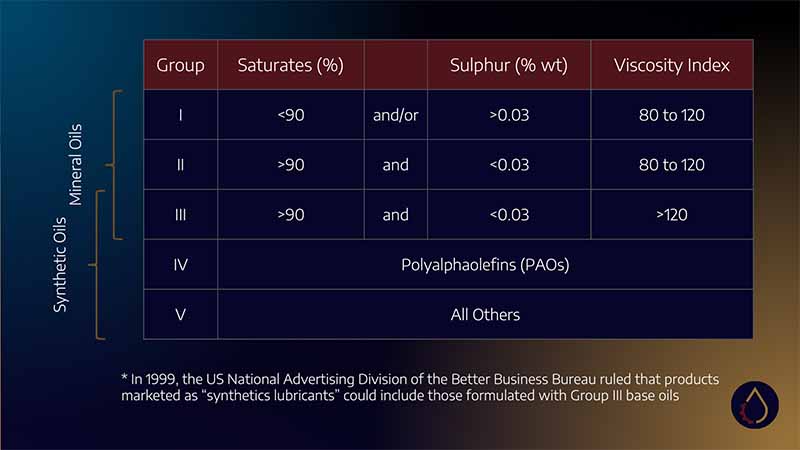

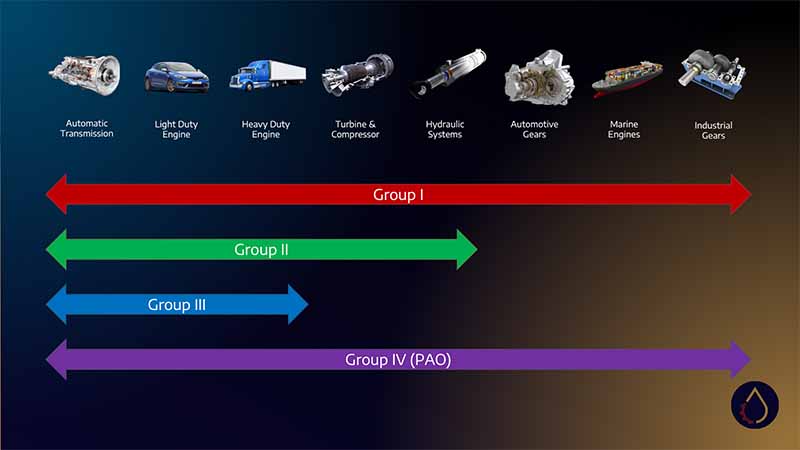

To understand these changes, we need to understand the role of Group I Bright Stocks in the global lubricants value chain. To recap – the American Petroleum Institute classifies base oils into five distinct groups, with the first three being mineral oils based on products refined from paraffinic crudes.

Generally, oxidation stability increases when moving from Group I – III, but the opposite is true for the solvency characteristics. Moreover, a general principle of refining is that the more crude is refined, the lower the viscosity of the finished product.

So, Group I’s are available in wider viscosity ranges than their Group II and III counterparts. This viscosity range is critical to industrial gear oils, where Group II and III base oils cannot create ISO 220 – 680 without heavy additization. So, for the vast majority of mineral gear oils, Group I is the base oil of choice.

Unfortunately, this venerated position is under threat. Lubes’n’Greases estimates that between 2010 and 2020, demand for Group I globally decreased by some 20%, and the overwhelming reduction of base oil production capacity from 2015 – 2022 was in the Group I’s.

The decline in demand is primarily driven by tightening lubricant specifications in the automotive market, forcing lubricant blenders to use the more oxidatively stable Group II, III, and IV base oils. Additionally, there are environmental concerns regarding the higher sulfur levels in Group I base oils and the solvent extraction methods used to refine them.

The potential impact on industrial gear oil formulations is four-fold:

- Price: Historically, Group I Bright Stocks have been a cost-effective option for producing high-quality lubricants. With its declining availability, formulators may be forced to source alternative base oils, many of which might be pricier.

- Oxidation Stability: A move to Group II gear oils would help increase the oxidation resistance of mineral gear oil formulations, increasing their longevity, particularly in high-temperature applications.

- Additive Solubility: One of the defining features of Group I Bright Stock is its solvency, ensuring that additives are effectively dissolved. These additives, ranging from anti-wear agents to viscosity modifiers, are crucial for gear oil’s performance. Manufacturers might have to invest more in co-base stocks to maintain effective additive solubility.

- Varnish Formation: Group I Bright Stocks’ solvency ensures oxidation products stay dissolved in the bulk oil. Doing so prevents them from settling out and forming harmful deposits. Without the superior solvency of Bright Stock, gear oils may witness increased chances of varnish formation.

It may initially seem paradoxical to list the effects of Group II gear oil formulations when the earlier discussion explained that the low viscosity of Group II base oils precludes them from use.

However, base oil manufacturing innovations will soon enable higher-viscosity base oils to be produced. ExxonMobil recently announced that expanding capacity in Singapore will include the production of EHC 340 MAX, a “heavy neutral” bright stock replacement with a viscosity slightly higher than ISO 460.

While this is a welcome innovation that plugs the gap left by the closure of Group I refineries, the potential for the rise in varnish formation is of particular concern. Anyone with experience in turbomachinery would be well aware of the increase of varnish impacting the performance of turbines and compressors in the last 20 years.

This change was (in part) due to the formulations moving from Group I to II and III and the reduced solvency of these formulations promoting the dropout of oxidation products.

This same phenomenon could be coming for gear sets. The coating effect of varnish impairs heat transfer, elevating temperatures in both the gear teeth and gear oil. This elevated bulk oil temperature further increases the oxidation rate, a vicious cycle that creates more varnish and deposits.

Not only this, but by reducing clearances in already tight gear meshes, varnish can negatively impact the efficiency of gear drives and dramatically increase wear rates.

While the value of many gear sets may generally not be as high as in the turbomachinery world, the sheer prevalence of gears throughout industrial machinery means this issue could become a severe problem for asset management teams in the coming decade.

It is instructive to learn from the varnish mitigation techniques used to good effect in the turbomachinery world – this can help reliability teams prepare to deal with the issue. Some modifications to existing practices may be required.

Varnish removal skids and solvency enhancement for turbomachinery often come in the form of large filtration skids that might not be appropriate for small, distributed assets like gear sets.

As always, the future is not set in stone, and the increase in varnish is not a foregone conclusion. Based on the macro industry environment, asset managers should begin preparing.